Brilliant Strategies Of Tips About How To Apply For Individual Taxpayer Identification Number

The tax identification number (tin) in singapore is a unique set of nine to ten digits.

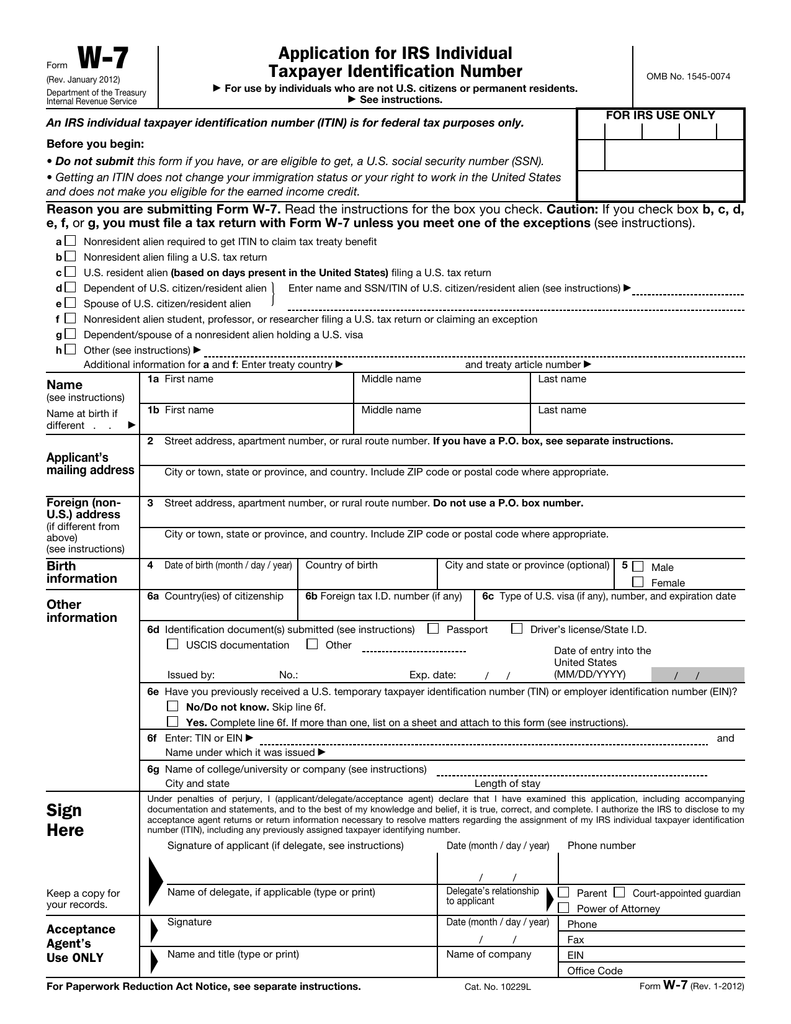

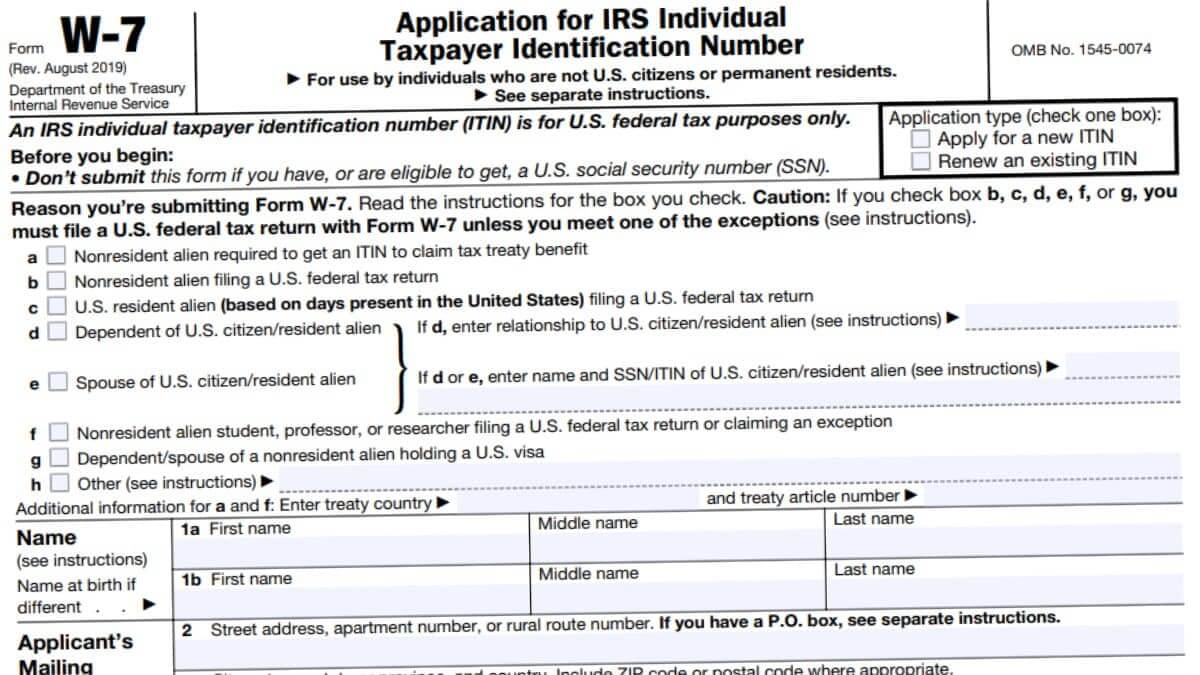

How to apply for individual taxpayer identification number. What is a tax identification number? This step is crucial as it ensures the irs can properly associate your new tax id with the correct entity or individual. You’ll need to answer questions about your citizenship and provide some basic information, such as.

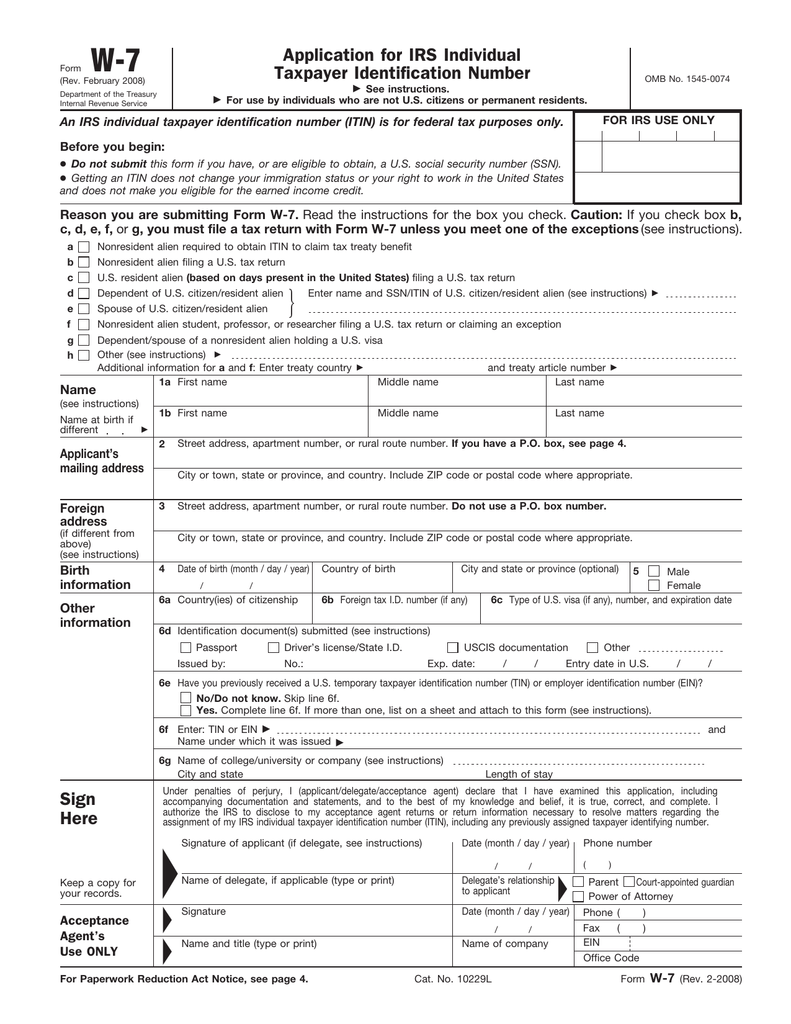

You can request an ssn at the ssa website. There are 3 ways you can apply for an itin number: The form requires detailed personal.

You may apply for an ein online if your principal business is located in the united states or u.s. When to apply for itin? Who needs an itin?

How to apply for itin? The person applying online must have. This interview will help you determine if you should file an application to receive an individual taxpayer identification number (itin).

Federal tax return at least once for tax years 2020, 2021, and 2022, your itin will expire on december 31, 2023. itins with. Obtaining a social security number. A company can obtain an ein by applying directly with the irs online.

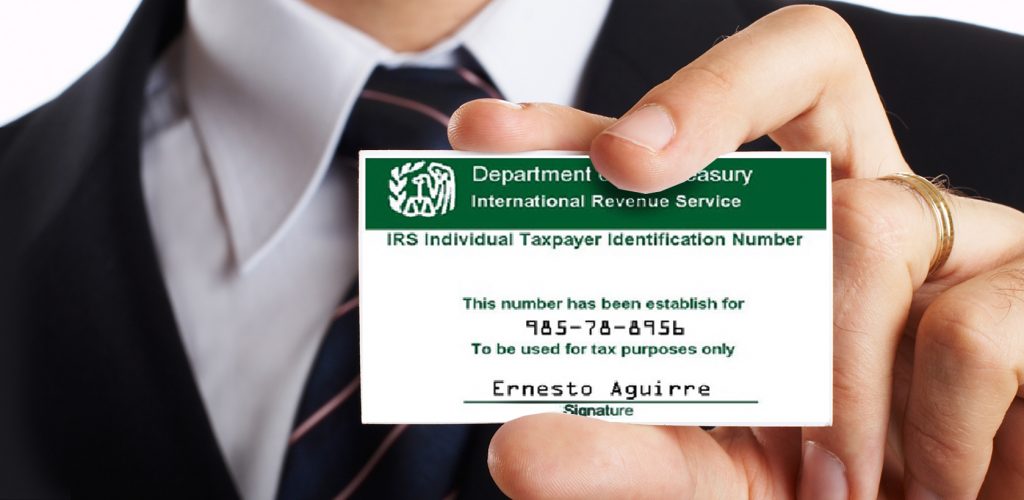

It helps prevent the misuse of the taxpayer’s social security. Since its adoption as the de facto national identification. You must prove your foreign/alien status and identity.

You can also use this form to renew an existing itin that is expiring or that has already expired. Understand social security numbers (ssn). Expired itins:if your itin wasn't included on a u.s.

File an application to waive or reduce canadian withholding tax on payments. How to get an itin: Also, you must supply a federal income tax return.

You may need to provide an itn to the canada revenue agency (cra) to do any of the following:

![Individual Taxpayer Identification Number (ITIN) Guide [2023]](https://www.immi-usa.com/wp-content/uploads/2021/08/Screen-Shot-2021-07-29-at-3.43.24-PM-1.png)

/tax-id-employer-id-397572-final-41c5a87996eb4ebd87dda185e52fea9a.png)