Who Else Wants Tips About How To Buy A House You Can't Afford

If you don't have a deposit saved up, you might think you can't buy a property.

How to buy a house you can't afford. Your savings account is simply. For example, did you know: Monthly debt / gross monthly income = dti %.

You don’t need a huge down payment to buy a loan. There *are* some other options out there for you. You get more space and added privacy.

A mortgage prequalification provides a. Anything else is icing on the cake. Toy houses and a no.

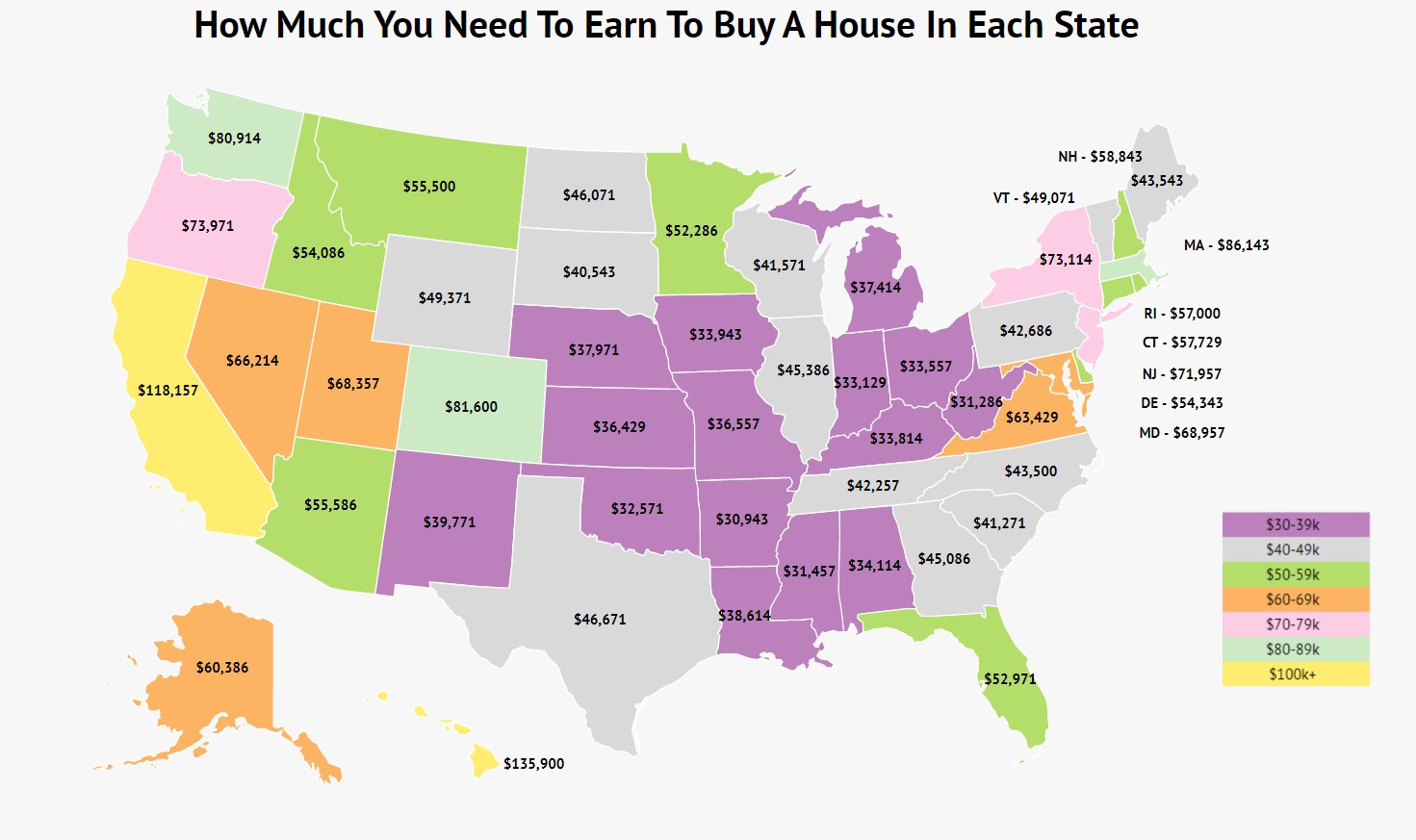

Try your luck at the lottery. $ advanced calculator disclaimer home price you can afford a house up to$229,813 based on your income, a house at this price should fit comfortably within your budget. Compare mortgages that could let you buy a home with a low income.

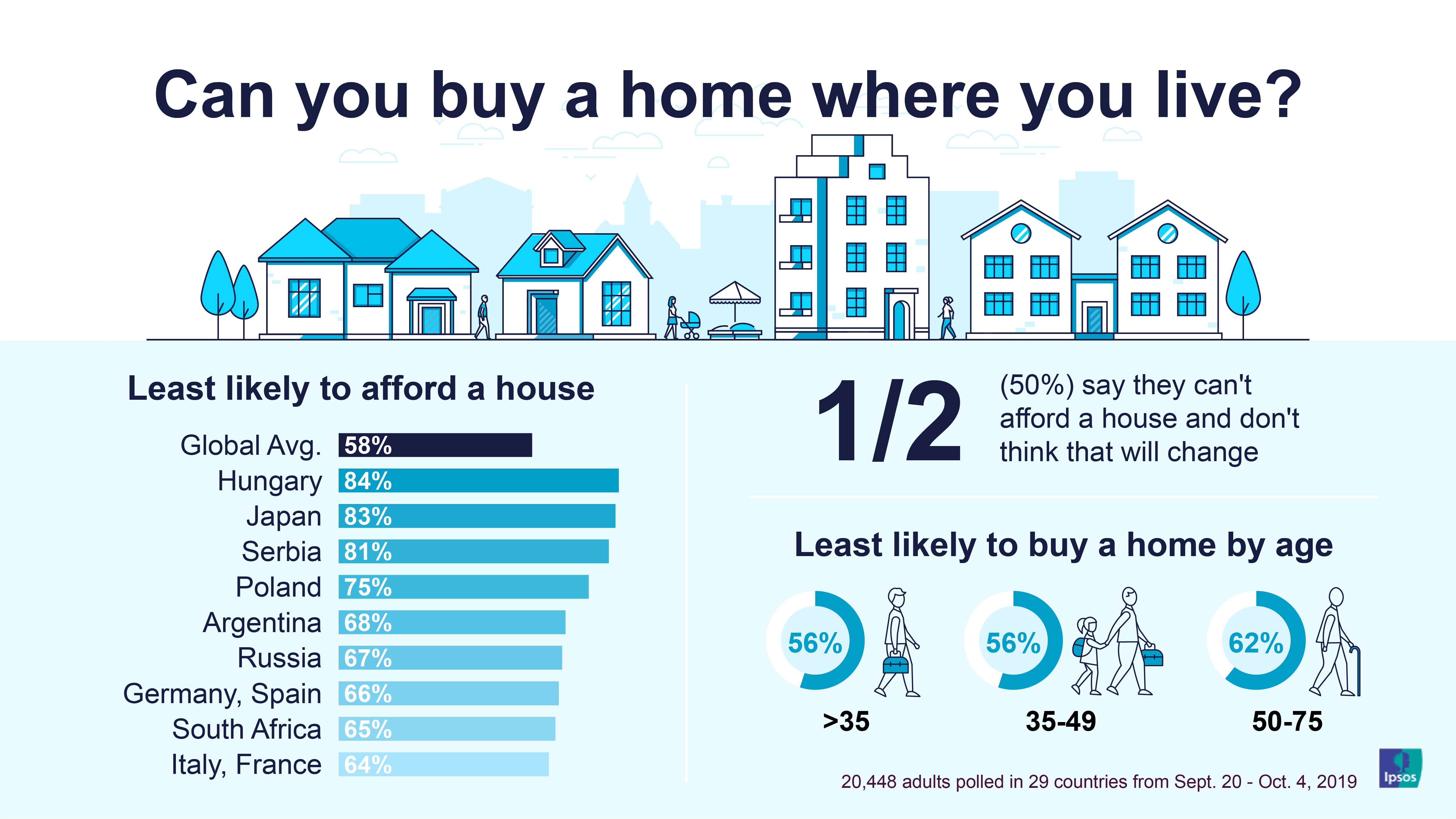

This means we’ll quickly assess your situation and then introduce you to a skilled broker who will best suit your needs. Maybe you’re still paying off student loans or living paycheck to paycheck. You’re not alone — more than half of aspiring homebuyers say they can’t afford it right now, according to a new survey from bankrate.

But there are alternative routes to homeownership. Buying a house is not as easy, or affordable, as it once was. Just call 0808 189 2301 or make an enquiry.

We spoke to three people who tried three different methods of getting into the. Generally, dti is displayed as a range of 20% to 50% and reflects an estimate of the top and bottom of your affordability. However, if you and your sister are listed as life tenants, you both have the right to live at your mother’s house for the rest of your.

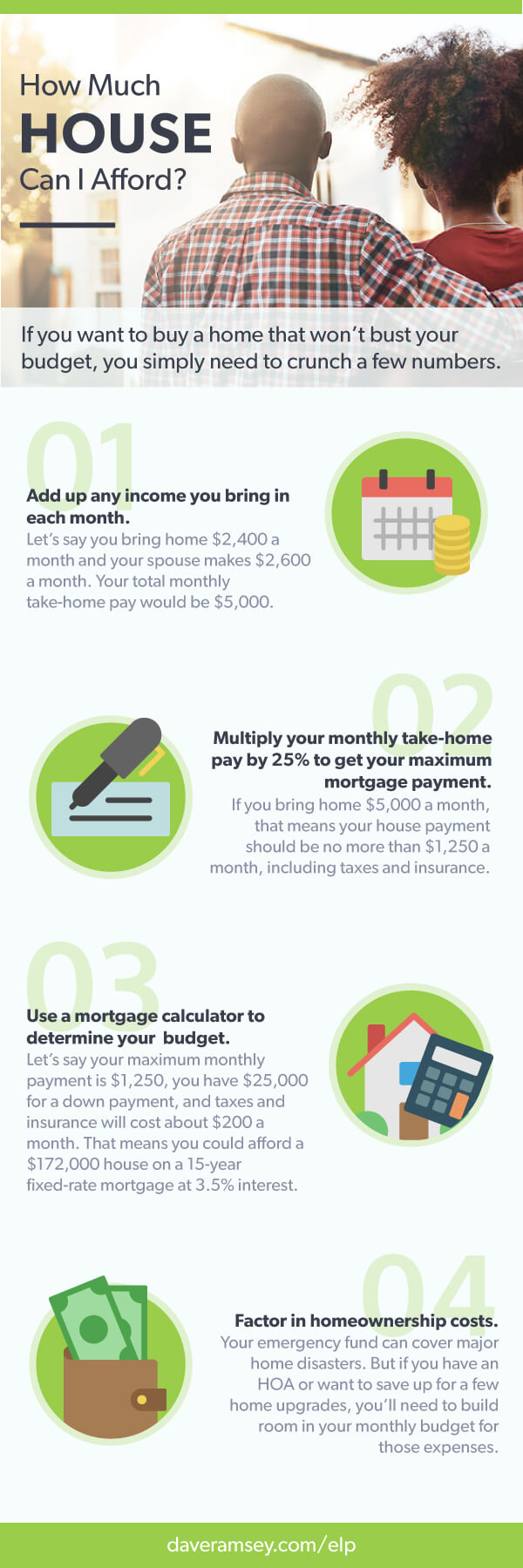

If you're wondering if you're ready to take on a mortgage loan and become a homeowner instead, you should consider whether you can truly afford it. Well, just hold up a bit. Say you’d like to buy a home but don’t think you can afford it, the first thing to do is check that assumption is right.

Whilst this may not be what you would like to do, especially if your house is your dream home, but you may need to. When it comes to buying a house, the numbers get so big they can start to lose meaning. You don’t have the 20 percent down payment.

Seek out a local mortgage professional to help you understand what you qualify for and set a realistic homebuying budget. Find out how much homes cost. Remember the reason you chose to save for retirement in.